Libération, 15 septembre 2018, p. 8-9.

Do Globalization, Deregulation and Financialization Imply a Convergence of Contemporary Capitalisms?

Discussion Paper Series 2018 #09: PAR · PUBLIÉ · MIS À JOUR

Abstract

Distinctive political compromises prevailed and explained various brands of capitalism observed from WWII to the early 1990s. Is this key finding by régulation research been still valid given the wide diffusion of common structural changes since the 2000s: slow productivity in the industrialized world, overwhelming impact of finance, rise of inequalities within many Nation-States in response to deregulation, social and political polarization, open conflict between capitalism and democracy, the trading place between mature and emerging economies? These stylized facts challenge most economic theories but they can be explained by an institutionalist and historical approach that also helps in redesigning a relevant macroeconomic approach. Each capitalism brand displays specific complementarities among institutional forms and their growing interactions imply more their complementarity than their frontal competition. Consequently, all capitalisms have been transformed but they do not converge towards a canonical configuration. The rise of nationalist movements may challenge the present international relations but they should not underestimate the economic and social costs of their protectionist strategy.

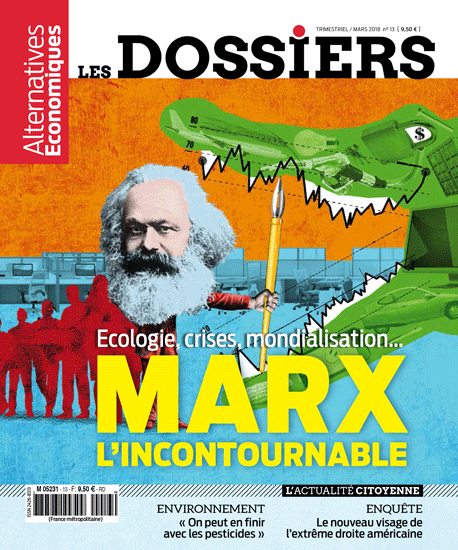

Entretien avec Robert Boyer et Jean-Marc Daniel, Alternatives Economiques, Les dossiers : Marx l’incontournable, p. 79.

Prepared for the Research conference “Pushing the Growth Models Agenda Forward”, Max Planck Institute for the Study of Societies, Cologne, May 23 and 24, 2018